Trading in the crypto sector depends on analyzing the market through data. However, amid all the data analysis, traders need to understand what’s happening in the market. For Coinbase, the latter presented it with an opportunity to craft and unveil new trading signals on top of the typical market data it already provides.

Now Coinbase customers have three new trading signals at their disposal once they log into their accounts.

There is Top Holder activity, Typical Hold Time & Popularity, and lastly Price Correlation. It is worth noting that Coinbase is only giving its customers new tools to help them make informed decisions: this shouldn’t be mistaken as a form of advice to sell or buy any asset.

Price Correlation

Coinbase Price Correlation signal is all about checking the movement of asset prices while comparing it with other assets. The latter ends with two results: high or low. Low or negative means the assets’ price in question has moved in the opposite direction.

However, no correlation means asset price movement isn’t related to any other asset. On the other hand, a high or positive correlation means assets’ price has moved in a similar direction. Through the data, customers can assess the diversity of their portfolio together with any potential risks.

Typical hold time & Popularity Signal

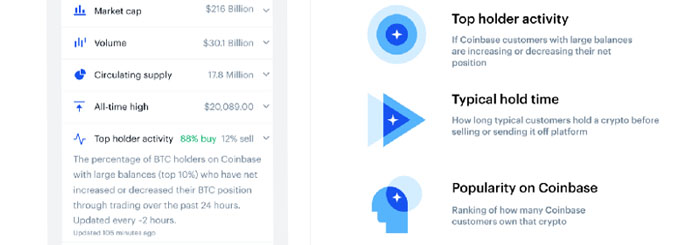

For Typical hold time, traders get the median number of days hundreds of other traders hold an asset on their vault or wallet before they move it out or sell the asset.

On the other hand, the popularity is a rank from all tradable assets involving the number of days traders hold a particular currency on Coinbase.

From the above data, traders have an insight into what other traders are doing and get a glimpse of where the market might head. For the above Coinbase updates the data on a 24-hour basis.

Top Holder Activity

Lastly, through Top holder activity, medium and small traders have a chance to see the positions of top traders whose assets balances account to 10% of trades on Coinbase exchange.

The latter are market shakers and whether they sell or buy their orders usually initiate massive price swings. For this, Coinbase updates the data every 2 hours.

Through that, other traders can gauge or predict the direction the market might take. However, the info isn’t a sign to sell or buy it’s all about helping other traders make proper decisions before selling or buying.