Latest Bitcoin [BTC] News

Good news is, the community is actively involved, raving about higher prices and the encouragingly, they expect more. Analysts as well as general investors project Bitcoin [BTC] to more than quadruple with Arthur Hayes of BitMex confident that by the close of the year, Bitcoin [BTC] will retest $10,000.

While this may happen, it is also practical to consider that the market is mature and many players are involved. It is not like the dynamics that contributed to the last parabolic rise of the last quarter of 2017 are still in play. Hype and general speculation was smoothen out last year when prices dropped by more than 75 percent.

Even so, the market is always on a treadmill, upgrading and most importantly, regulations in different parts of the country seem to be acknowledging that Bitcoin and cryptocurrencies in general can contribute positively to the economy.

That is extremely bullish and as the community wait anxiously for the US SEC to comment on any of the nine Bitcoin ETFs or for the CFTC to give the green lights for the now forgotten Bakkt daily Bitcoin Futures, all factors are aligned with price action. Defining trend were upswings of early April close above crucial resistance trend lines and while prices may range for a while, bulls are clearly in control.

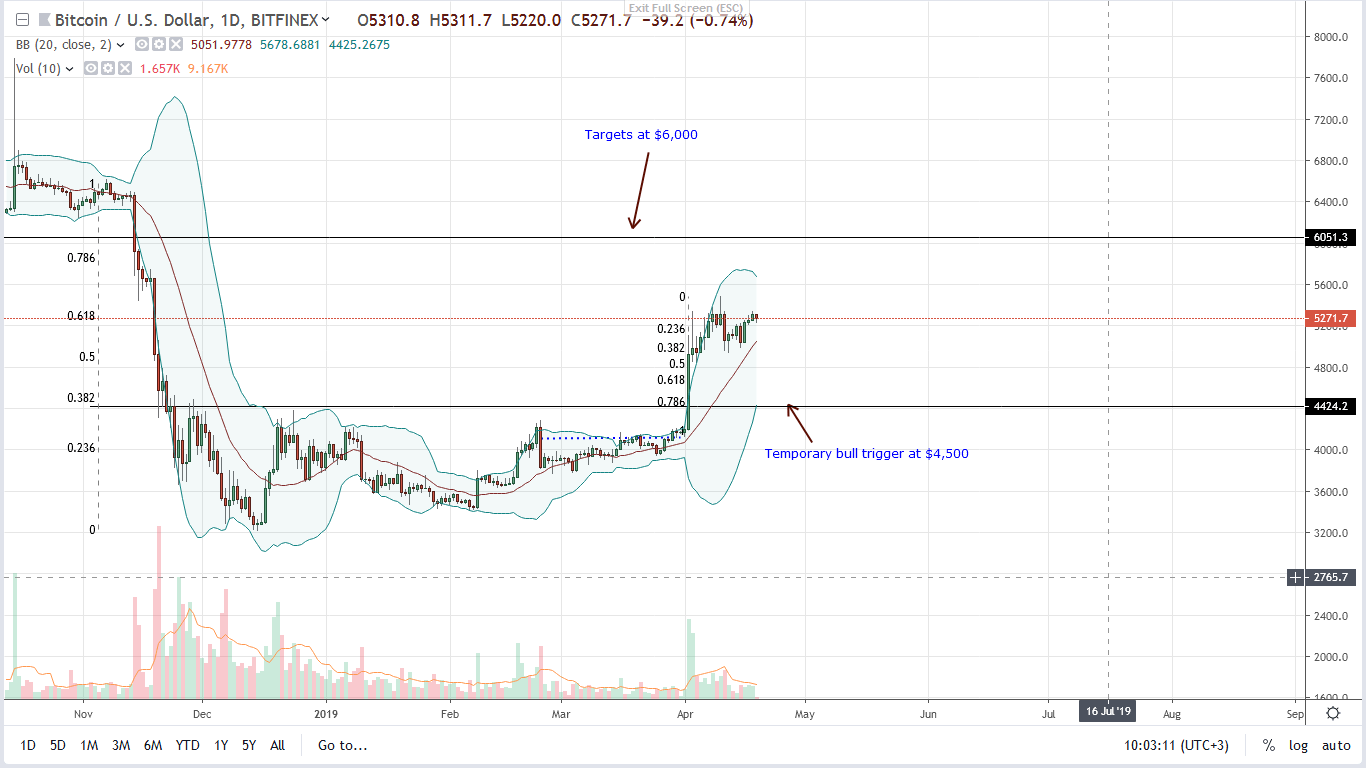

BTC/USD Price Analysis

At spot rates, Bitcoin (BTC) is range mode and yet to overcome sellers of early this week. Notice that prices is up 3.9 percent in the last week and pretty stable in the last 24 hours. Even so, the path has been set as aforementioned.

However, for buyers to be in control, then there must be a high-volume, close and break above Apr-10 highs at $5,500. Therefore, that means a satisfactory reversal of Apr-11 draw down and a wide-ranging close above $5,500 confirming buyers of Apr-2-5 in a trend continuation phase.

While that will be ideal, it is also objective to note that sellers may as well flow back because the volumes behind Apr-11 losses were high. That is why it is paramount for conservative traders to wait for a high-volume close above $5,500 as aforementioned. Presently risk-off, aggressive traders can buy on dips with first targets at $6,000 and later $8,000.

Chart courtesy of Trading View—BitFinex

Disclaimer: Views and opinions expressed are those of the author and not investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.