In this BTC/USD Price Analysis we will see how the latest news related to the cryptographic sector affects the Bitcoin prices and what is the nearest future for this cryptocurrency according to the graphs.

In a sphere that many consider unregulated, government involvement quickly becomes the much-needed legitimizing stamp of approval. This is why plans to classify crypto trading a commercial activity and somehow monitor activity of high net worth coin holders for tax compliance is somehow positive though many will argue against the case.

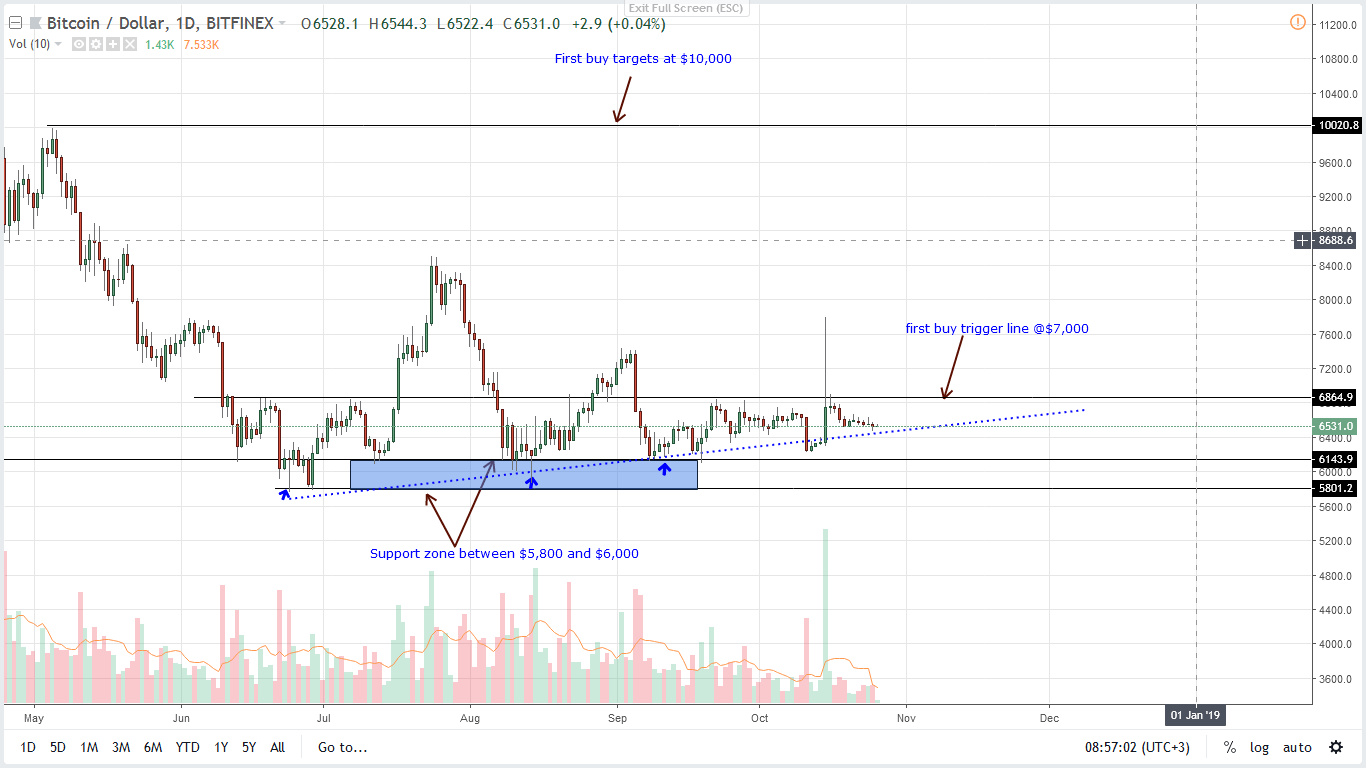

In the mean time, there are hints of higher highs and that’s why we suggest small position buys with first targets at main resistance line and buy trigger at $7,200.

Latest Bitcoin [BTC] News

Even though the draft legislation is yet to be approved, the Spanish government is working overtime to ensure that a new anti-Fraud draft regulation becomes law.

In a statement, María Jesús Montero, the Spanish minister of finance said the law mandates Spanish citizens and businesses-even those operating outside the country–to clearly identify themselves with their cryptocurrency holdings –this applies to those more than 50,000 Euros in crypto or who invested more than 20,000 Euros within a year– and to annually declare their crypto assets relevant Spanish tax authorities.

Considering the economic turmoil in the country, it appears authorities are trying to ring fence potential revenues from crypto related businesses as they move towards raising an extra $800 million in revenue. This is inevitable especially if you bring in their need to fund different investments and welfare spending in a country with close to 30 percent youth unemployment rate.

At the moment nothing has been substantiated but odds are the draft law will be enforced and that’s where crypto traders in Spain should go through the law to understand the nitty gritties around the government decision to classify crypto trading a commercial activity where Tobin tax is applicable.

Tobin tax directs that crypto related, intra-day transactions are subject to tax depending on the position at open and close of a trading session. A team of 200 officials will be deployed to help the government monitor and clamp down tax evaders and defaulters owing the country’s treasury more than 600,000 Euros.

Bitcoin Price Analysis – BTC/USD

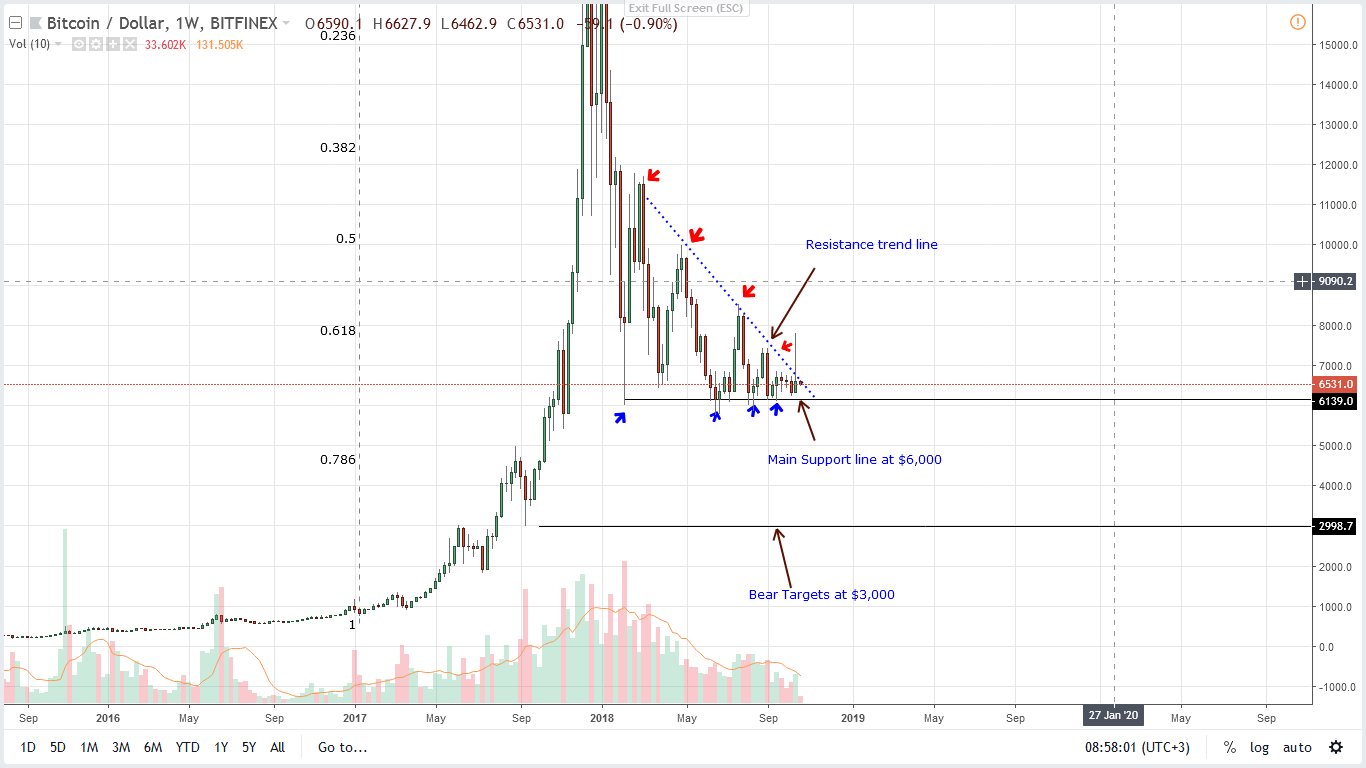

Weekly Chart – BTC/USD price prediction

As mentioned in our previous BTC/USD price analysis, our long-term position of the coin depends on rallies above $7,200 our immediate resistance line and main bull trigger line.

However, considering the level of inactivity in the last four months as prices were largely ranging inside a larger $1500 zone with clear supports at $5,800–$6,000 area, it will be victory if prices rally past the main resistance trend line.

Overly that will constitute a bullish break out and could mark the beginning of a bull trend after prices fell +80 percent from 2017 highs. On the flip side, it will be deflating for vibrant bulls if prices dip below $6,000 main support line and 2018 lows because it could herald the beginning of a new wave of sell pressure complementing those of this year and it would be inevitable for BTC to print below $5,000 more so if the bear break out is accompanied by high trade volumes.

Daily Chart – BTC/USD price prediction

This is bullish and as volumes recede, all indications points to higher highs and that is why we suggest buying at spot prices with first targets at $7,200. Fitting stops will be at $6,300 which is Oct 15 lows. Needless to say, should there be unexpected declines and bears take out our stops then we shall revert back to neutral.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.