Latest Bitcoin [BTC] News

The good thing about Bitcoin [BTC] and general cryptocurrency trading is the presence of a vibrant secondary and over the trade counter markets. The OTC market is quite stable and liquid.

That’s why institutional investors prefer to trade in a somewhat volatile free environment where they can transact in large volumes that would otherwise cause prices to fluctuate in standard crypto exchanges.

So, rather than splitting large orders because of centralized exchanges order size limits—which can be fatal, large chunks of BTC or ETH lots are executed in technologically advanced firms with better infrastructure that can handle large orders.

Now, during the bear market, several funds reported that institutional traders and high net-worth individual were flocking and loading Bitcoins en masse. According to a recent report by Diar, the demand for BTC in these “decentralized firms” is so high that there is a shortage of sellers.

By comparing OTC volumes between those of CoinBase and Grayscale’s OTC-traded Bitcoin Investment Trust (GBTC), research indicates that though trading volumes were down 35 percent year to date, Grayscale pulled in $216 million in investment in the first three quarters of the year.

From this we can easily conclude that though round the clock centralized crypto exchanges have their advantages, institutional grade investors prefer liquid OTC market at current prices stocking in preparation of the next bull market

Bitcoin [BTC] Price Analysis

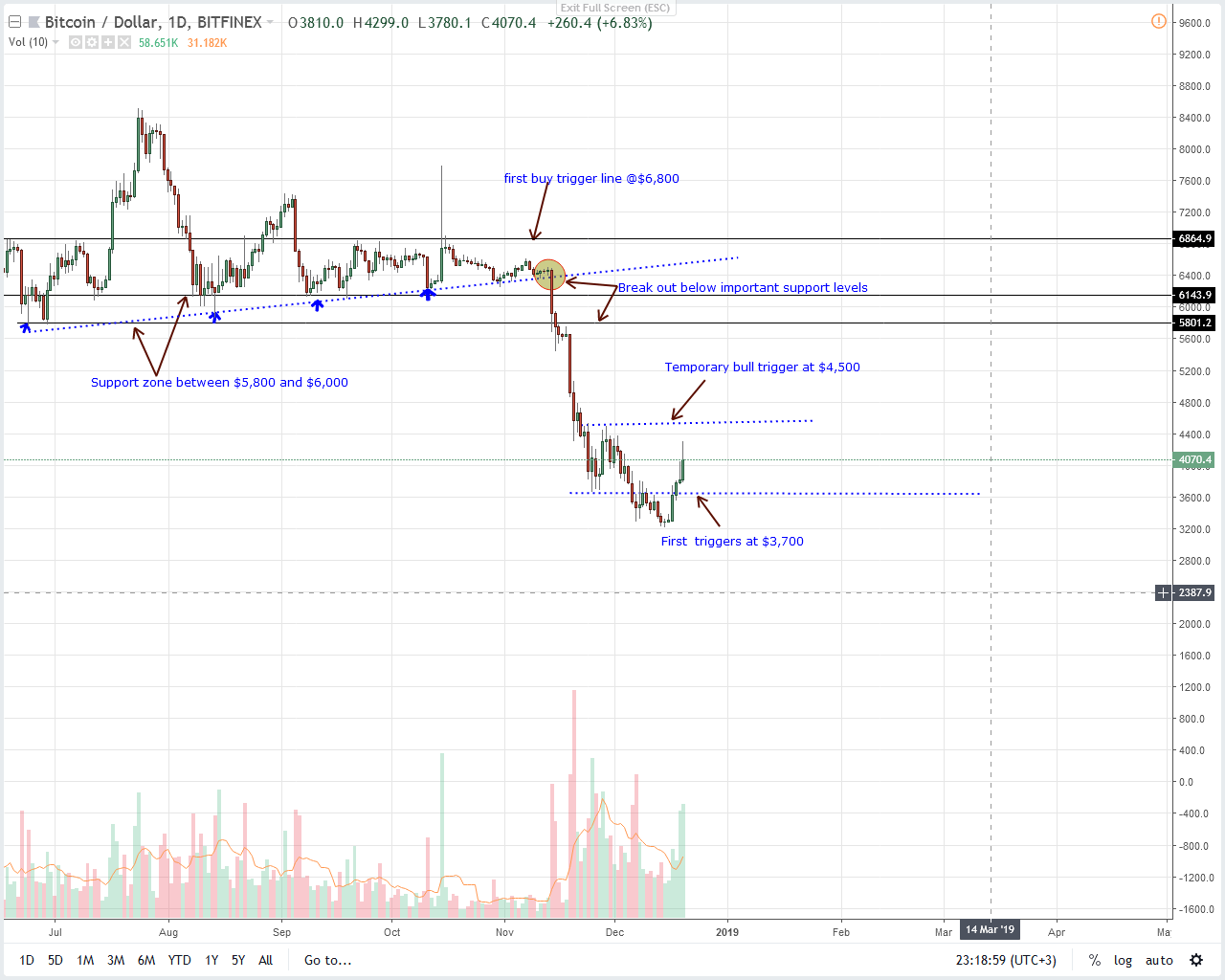

Daily Chart – BTC/USD

From a top-down approach, BTC is technically bearish despite recent prices surge that has since propelled prices above $4,000. At spot rates, BTC is up 7.7 percent against the USD in the last day and up a massive 17.3 percent in the last week meaning bulls are backing, raring to go.

However, just like every asset, we should proceed with caution. In line with our previous reiteration, high-volume gains above $4,700 could found the rails exposing BTC to $5,000 and even $6,000.

It is for this very reason why we suggest the conservative type of traders to wait until there is a stable close above the accumulation at $4,700. As it is, BTC prices are likely to retrace back to around Nov lows of $3,700 before bouncing back above $4,000.

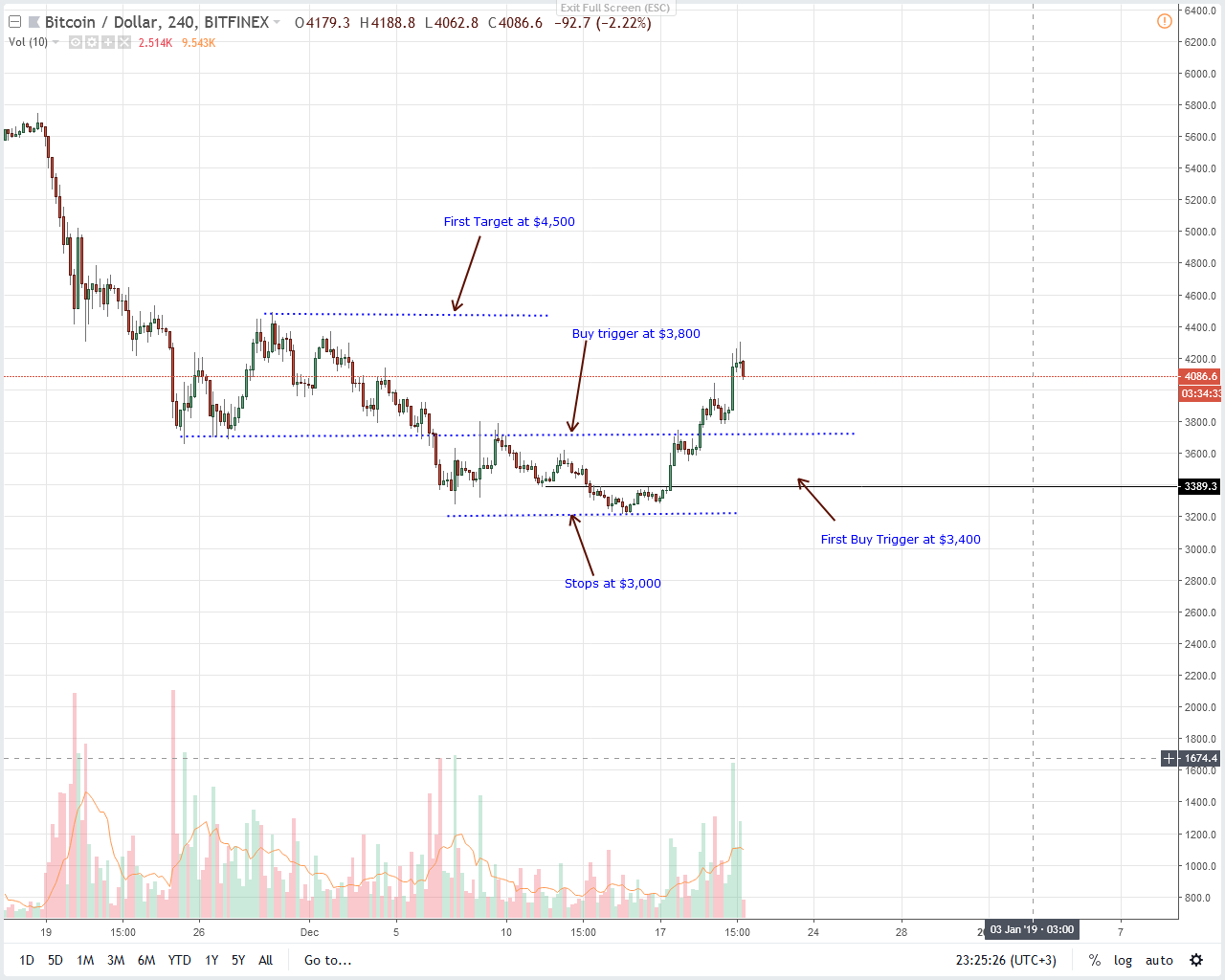

4HR Chart – BTC/USD

In this time frame we have a classic three bar bear reversal pattern—the Evening Star and with decent volumes behind Dec 20, 1100 HRs bull bar, this correction could print out with light volume.

The ideal level of support is at $3,700 or Dec 20 lows. However, if prices spring above $4,300, the traders should buy at spot rates with first targets at $5,000.

This is our BTC/USD trade plan:

- Buy: $3,700, $4,300

- Stop: $3,500, $4,000

- Target: $5,500, $6,000

All Charts Courtesy of TradingView

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.