Latest Bitcoin [BTC] News

The question everyone has been asking themselves is whether the US SEC will give the go-ahead and approve any of the nine Bitcoin ETF proposals under their review. Well, the commenting period is over and with SEC Commissioner Hester Pierce—well known for her dissenting comment–hinting that the Bitcoin ETF is a possibility while refusing to comment on whether it is inevitable, SEC boss Jay clayton poured cold water on Bitcoin ETF hopes.

While attending a NY conference, he said the commission shall only approve the ETF once the market is free from any form of manipulation and that those who want to participate in this market see sense once they get in. At the moment, the Jay said there are no safeguards to prevent manipulation and the lack thereof is the main obstacle for approval.

Meanwhile, the United States Treasury Department Office of Foreign Assets Control (OFAC) has sanctioned two Bitcoin addresses and prohibited any US citizen from sending funds to the twoaddresses

- 149w62rY42aZBox8fGcmqNsXUzSStKeq8C

- 1AjZPMsnmpdK2Rv9KQNfMurTXinscVro9V

while urging stakeholders in compliance and the crypto community to investigate and even “ban” these two addresses.

This is the most ridiculous move from a government agency because while they can issue punishment to individuals behind the SamSam ransomware scheme which caused damage, Ali Khorashadizadeh and Mohammad Ghorbaniyan—the owners of the BTC addresses, can create infinite number of addresses and continue receiving coins unabated.

BTC/USD Price Analysis

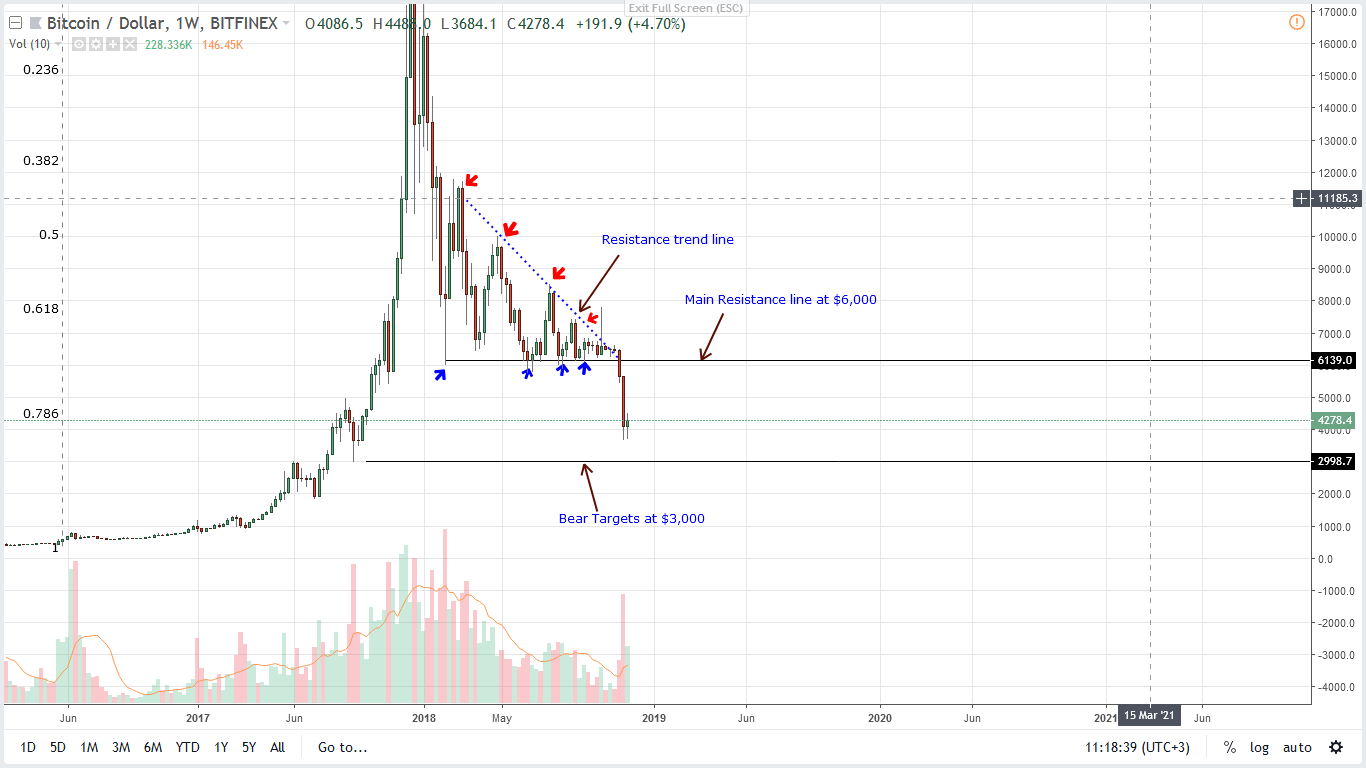

Weekly Chart – BTC/USD price prediction

From candlestick arrangement, notice that sellers are in charge and with a whole bear bar printing below the main support line at $6,000, it will take a lot of effort before we recommend buyers to fade the trend and load this trend.

That’s unless there are super strong moves breaking and closing above $5,800–$6,000 resistance zone at the back of high market participation exceeding last weeks—that is volumes should be above 435k.

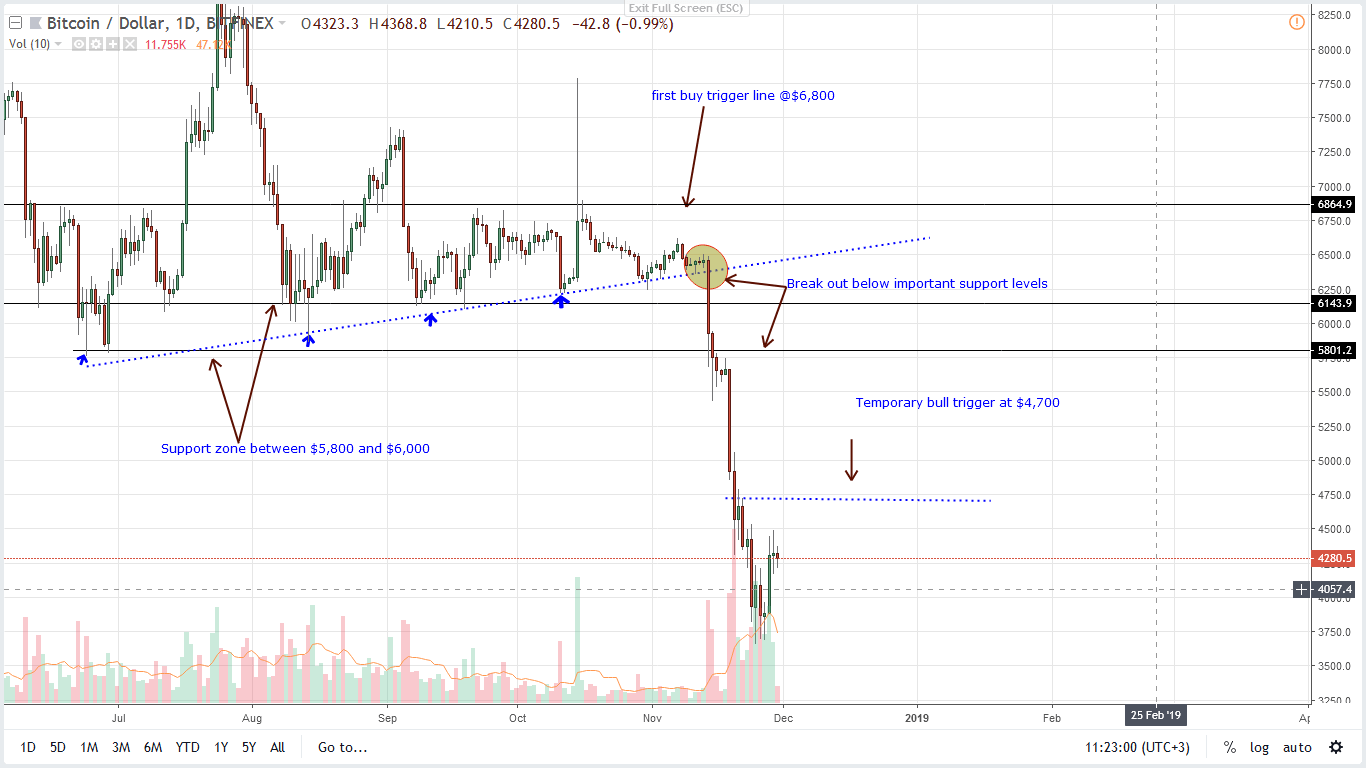

Daily Chart – BTC/USD price prediction

As a result of this, aggressive traders should begin loading up in lower time frame, buying on dips with stops at $3,900 and first targets at $4,700, $5,000 and later $5,800 in a move that will signal the end of bear reign.

If not and prices drop below $3,700 crashing our stops, BTC/USD could end up to $3,000 as projected in our last BTC/USD price analysis.

All Charts Courtesy of Trading View

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.