The CBOE Decision

In a flash decision that could further delay the listing of the first Bitcoin ETF in the US, CBOE BZX Exchange has withdrawn their Bitcoin Exchange Traded Fund (ETF) proposal to the US Securities and Exchange Commission (SEC).

This is a month before the SEC’s landmark decision. Although given the circumstances around the possibilities of a Bitcoin derivative in the US, it was likely that the SEC would have rejected their application in their next sitting.

Earlier this month, Jay Clayton, the chairperson of the SEC, said even though there was progress, there was still “work left to be done”. The decision by the CBOE BZX exchange to pull out could be strategic.

Institutions exposed to Bitcoin despite the Pullout

Under Rule 144A of the Securities Act of 1933, they are offering the VanEck SolidX Bitcoin Trust 144A Shares, to limited institutional investors.

In their selection criteria, these high net worth investors must have assets under management exceeding $100 million.

So far, only four shares worth over $40,000 have been sold. Despite their decision to back off, Gabor Gurbacs, the director of digital asset strategies at Van Eck, in a tweet, said:

We are committed to support Bitcoin and Bitcoin-focused financial innovation. Bringing to market a physical, liquid and insured ETF remains a top priority. We continue to work closely with regulators & market participants to get one step closer every day.

BTC/USD Price Analysis

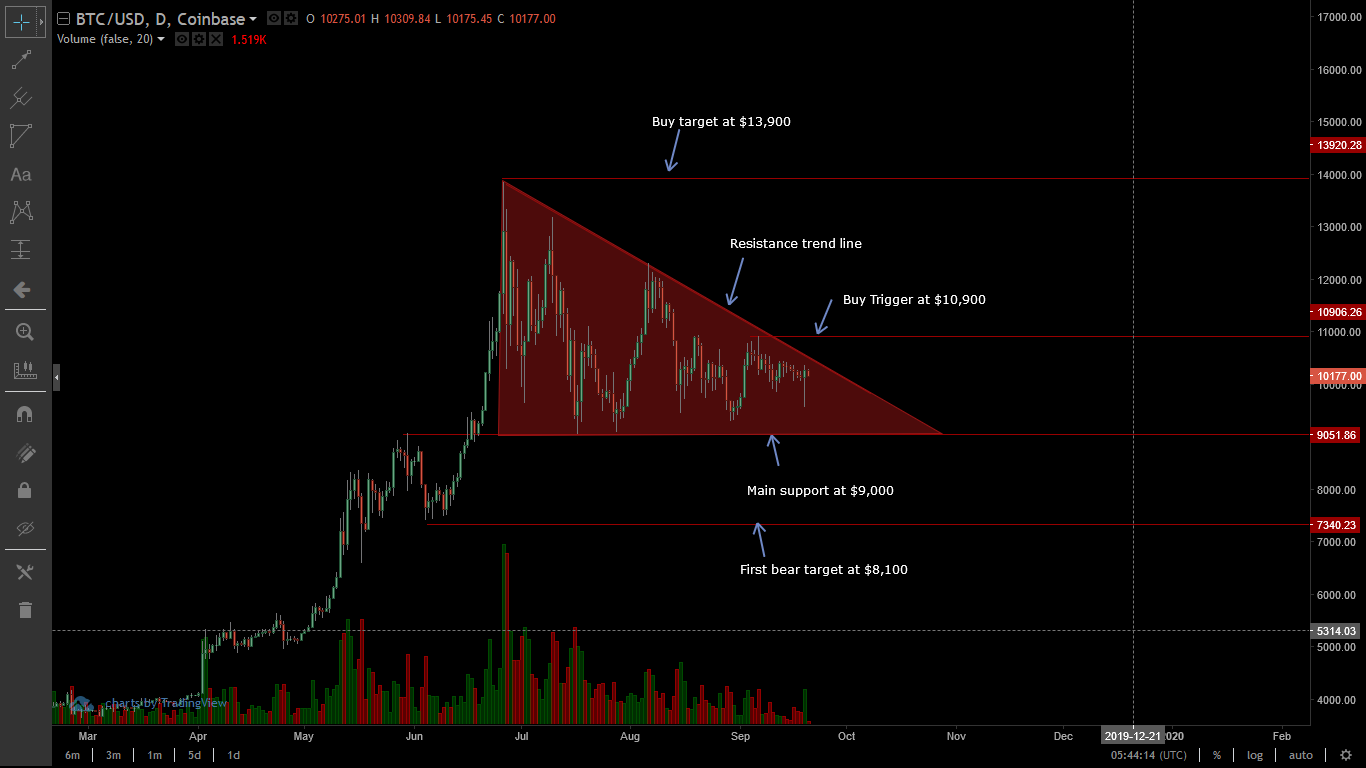

Amid an altcoin resurgence, BTC is flat against the greenback and ETH. Registering minor gains-and losses, in the last 2 hours, prices are treading inside a bull flag in the daily chart. Technically bullish if candlestick arrangements guide this overview, the best course of action for traders is to take a wait-and-see approach.

After yesterday’s dip and subsequent recovery of BTC prices resulting in a long lower sick candlestick showing demand in lower timeframes, it is likely that prices could break out in coming days.

Note that there is an uptick of trading volumes and even if the resistance trend line is limiting bulls, rejection of lower prices below $9,500 builds a foundation for a surge towards $11,000 and beyond.

Apart from ranging prices, BTC is at the final third of a triangle. Historically, this is where prices tend to either surge or collapse at the back of high trading volumes. If prices edge higher, closing above $10,500, then traders should buy the breakout with first targets at $12,200 and later June highs of $13,900.

Conversely, losses below $9,000 could see BTC collapse to $8,100 or worse, $5,500 as mentioned in previous BTC/USD price analysis.

Chart courtesy of Coinalyze

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.