Joseph Lubin, the co-founder of Ethereum and the head of ConsenSys is upbeat about ETH. Despite losses, he views the number of projects building their application on Ethereum blockchain as positive.

Latest Ethereum [ETH] News

Smart contracts—the trustless, self executing, autonomous contracts was lauded as revolutionary during launch. It shall continue to be and even as ETH, the native coin oiling the Ethereum ecosystem drop in fiat terms, more businesses are moving their applications and launching them on a secure, distributed and community trusted blockchain.

While price and ETH are up in multiples three years after launch, many are forgetting what really matters: adoption. The measure of adoption is the number of transactions done on chain and it’s on the rise.

According to a new study released by SFOX, the use of smart contracts varies but a stand out in all this is that most smart contracts were executed by exchanges—decentralized and centralized, contributing 50 percent of all the 30 million transactions analyzed. 40 percent of all transactions went to ICOs while the rest, 10 percent were used to secure crypto-collectible transactions.

This break down hints of something else: that smart contracts are not used for revolutionary purposes other than shifting ETH and similar tokens from one address to another. In fact, the study goes on and further point decentralized exchanges as Etherdelta as the main users of smart contracts and that’s understandable considering smart contracts is the only security in these systems. In case of losses there is no repatriation like in centralized exchanges.

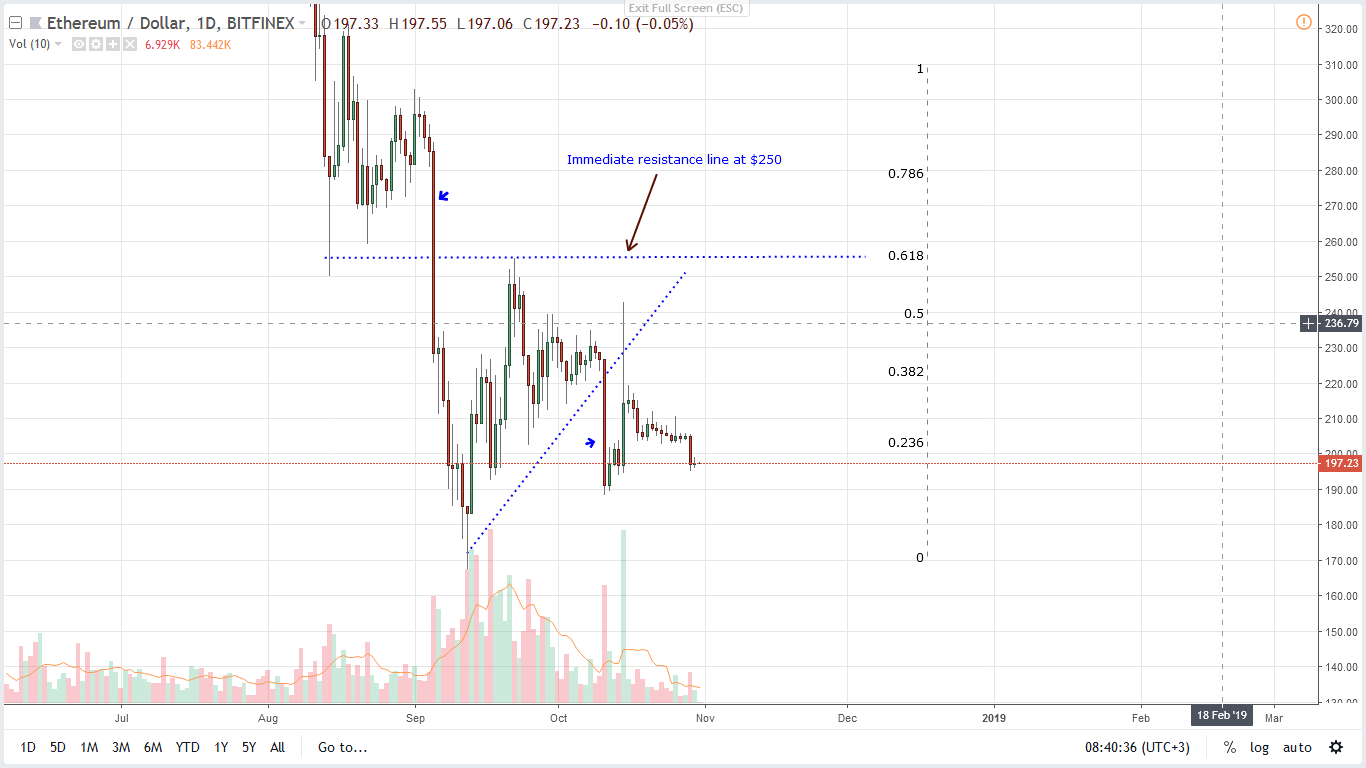

ETH/USD Price Analysis

Weekly Chart – ETH/USD Price prediction

![Ethereum [ETH] prices ETH/USD](https://crypto-economy.com/wp-content/uploads/2022/12/Ethereum-Weekly-Chart-Oct-31.png)

Therefore, like before, we shall retain a conservative forecast advocating a neutral stand as long as prices are trending within $160 and $250 trade range. These two levels are important in our analysis and at the moment, odds are prices will pull back and ease off from the $200 psychological level now that ETH/USD is down +80 percent from 2017 highs.

Daily Chart – ETH/USD Price prediction

As such, we shall take a wait-and-see approach and the moment it prints, aggressive trader should begin loading up on dips with stops at around $210. However, since we are technically bullish given this year’s losses, any snap back buoying prices causing Oct 29 reversal should be interpreted as bullish.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.

![Ethereum [ETH/USD] 31/10/2018](https://crypto-economy.com//wp-content/uploads/2019/07/eth-analisis.jpg)