Latest Bitcoin (BTC) News

Behind the thoughts of every startup founder (s) is first, how they will create a solution for an existing problem. Secondly, implement that solution and turn their platform into a success. Despite criticism from some quarters, startups are firms and the so called first principles are fortunately not shelved.

They anchor every road map. Just like what Facebook is doing. Even after a baptism by fire, every crisis seems to embolden them towards fast-tracking their development and negotiation as they plan to launch a master Stablecoin.

The Global Coin, they say, will be massively beneficial for developing economies, rivalling Bitcoin. By taking advantage of what the need for stability, which Bitcoin fails to offer, Global Coin will intentionally build a parallel “crypto” economy on their systems. Facebook, with more than 2 billion users, and WhatsApp-boosting equal numbers, will come in handy.

Prepared to address the questions around centralization, it is said they will create a foundation. The foundation will in turn act like a criticism sink, allowing the network to advance and concurrently comply with regulatory requirement.

Meanwhile, to shield and even differentiate itself from Stablecoin threat, Bitcoin will uniquely remain decentralized. Apart from that there are on-chain and off-chain solutions that address scalability with Tap Root and Schnorr signature at the fore.

BTC/USD Price Analysis

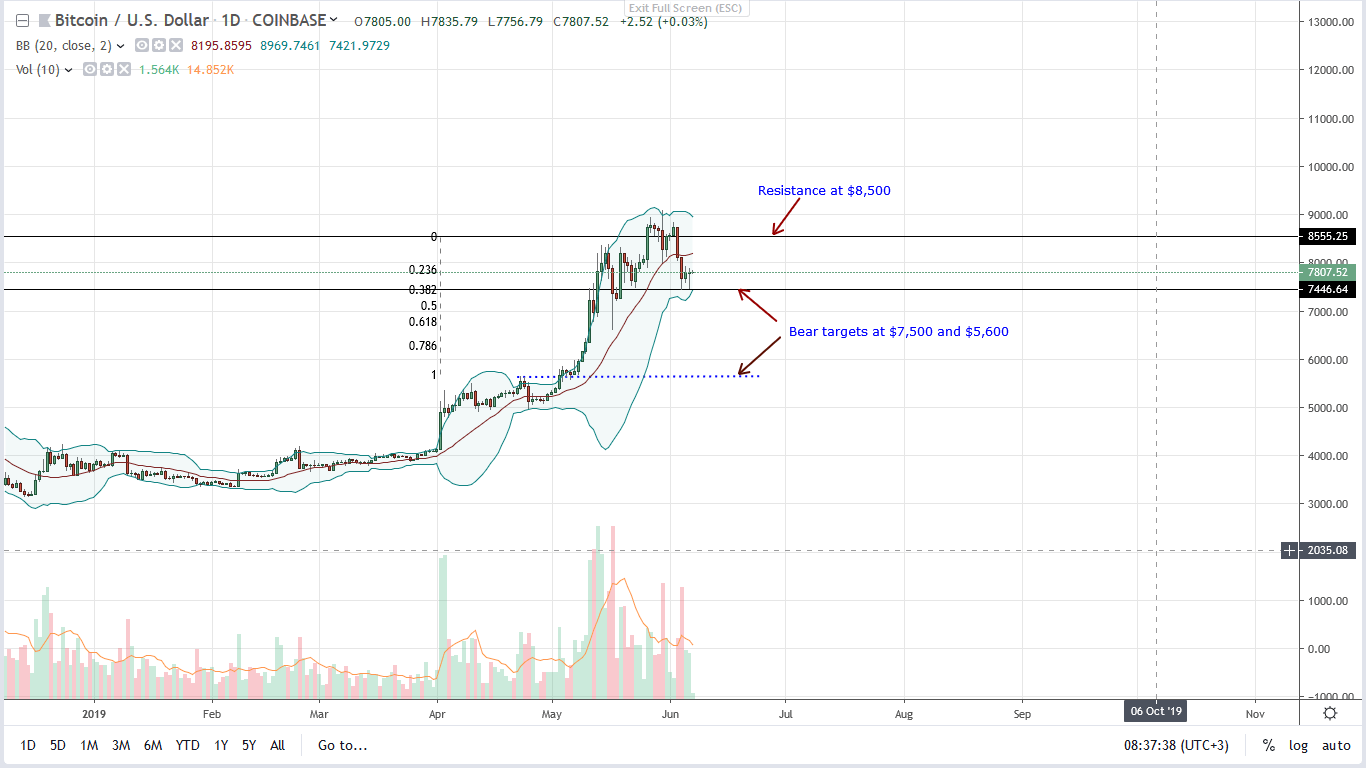

At the time of writing, Bitcoin (BTC) the world’s most valuable coin is down 6.1 percent from last week’s close, compounding the misery for holders.

Even so, it all depends on whether prices will find support at the $7,500 mark. The level is the lower limit of the $1,000 range from where BTC has been ranging against the USD in the last few weeks. Unless otherwise there is a high trading volume break and close below level, buyers are in control.

If not and there is liquidation as bears of May 30th flow back while aiming at $5,600, the best option for traders will be to exit their longs. Afterwards, they may fade the main trend. Ideally, what should accompany this meltdown, marking the breakout below $7,500 is high participation with trading volumes exceeding May 30th of 31k.

Similarly, any upsurge above $8,500, rewinding this week’s losses and cementing buyers should be a wide-ranging breakout marked by an uptick of trading volumes.

Chart courtesy of TradingView—Coinbase

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.