Latest Bitcoin [BTC] News

For a while now, the Bitcoin and the crypto community is saturated with talk of institutional involvement and for good reasons. Should these institutions and high net-worth individuals make forays, it is obvious that assets will receive capital injections. In return this will deepen liquidity taming volatility.

Although figures are not that clear, we are already seeing evidence of this. Bitcoin volatility trackers continue to report low volatility and at some point, researchers found out that Bitcoin—despite attacks from critics, was less volatile than select FANG stocks as Netflix for example. And we must note, this was without the explicit involvement of HNWI and institutional grade investors.

Products like Bitcoin Futures and ETFs would definitely spur participation but the US Government shutdown is slowing things up and already, the CBoE has temporarily withdrawn their VanEck and SolidX Bitcoin ETF proposals. This was one of the nine proposals forwarded.

Note that unlike other proposals, the VanEck and SolidX sponsored proposal was backed by physically Bitcoins and not futures. With this, hopes of a Bitcoin ETF continue to fade and because SEC employees cannot review any rule change, commentators are convinced that prospects of an ETF—meant to spur institutional involvement—is now slim to none.

BTC/USD Price Analysis

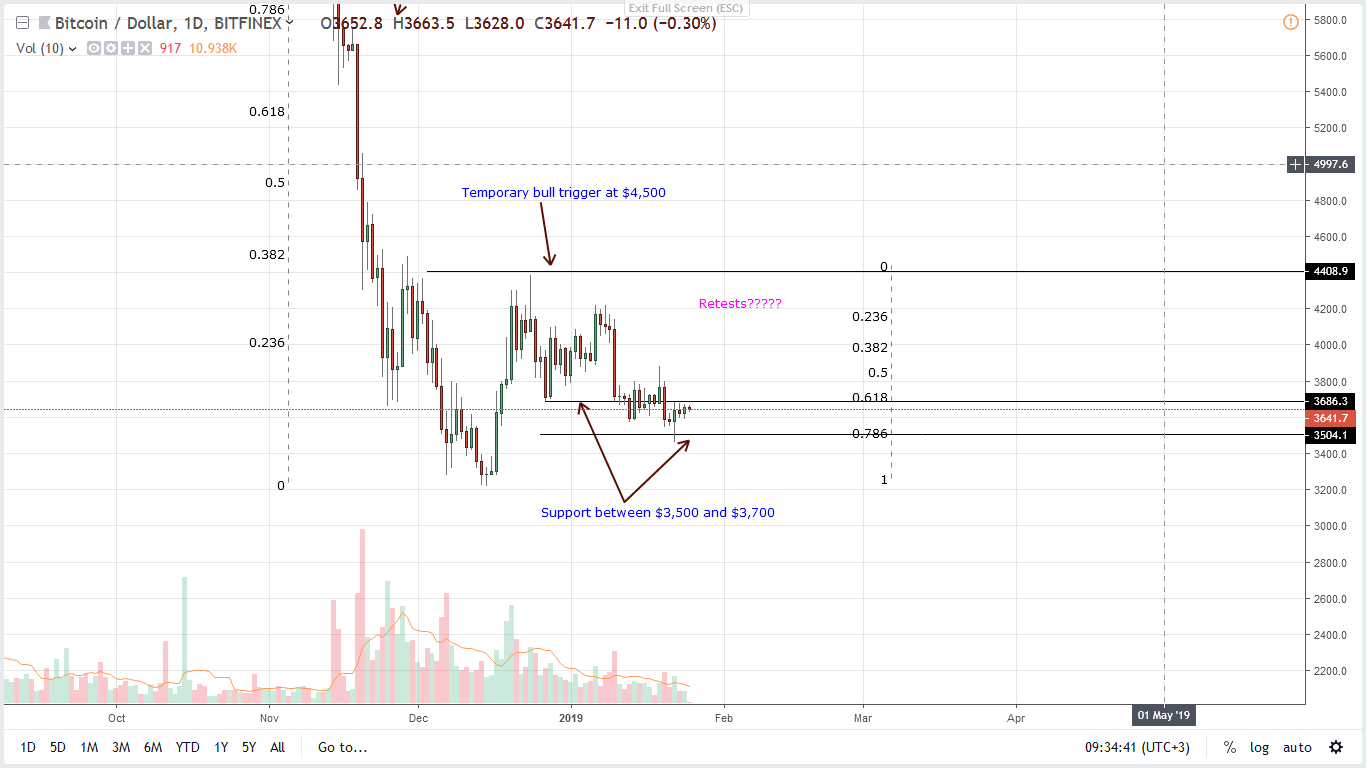

In a short-term uptrend, BTC prices are struggling to inch higher and trading within a descending channel or our bull flag. As mentioned in our previous Bitcoin trade plans, BTC bulls will only be in charge once prices edge past $3,800 and later $4,500. The latter being an entry level for conservatives aiming at $6,000 or higher in the medium-term. All the same, it is clear that fundamentals counter technical candlestick arrangement which favors Bitcoin.

However, our optimism depends on the reaction of BTC prices at the $3,500 mark—or the 78.6 percent Fibonacci retracement mark of Dec 2018 high low and $3,800 mark as aforementioned. Before any of these levels are tested, we advice patience although we remain bullish expecting a follow through of late Dec 2018 upswings. Note that in the short term, a clear obstacle is Jan 10 bear bar. It is backed by high volumes—35k, which is way above recent averages—12k.

Obviously, a break above appears insurmountable and because of participation level disparities, complete reversal mean BTC prices must expand above $4,500 meaning conservative traders should be save as far as risk-reward is concerned.

All Charts Courtesy of TradingView—BitFinex

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.