The adoption of blockchain solutions continues to expand in the investment sector. In itself to speak of blockchain is to invite to think about investing. The versatility of this technology allows the management of traditional financial instruments in a more secure and efficient way. With these premises we will talk about the Jibrel network. The Jibrel Network provides currencies, stocks, commodities and other assets and financial instruments such as standard ERC-20 tokens in the Ethereum block chain.

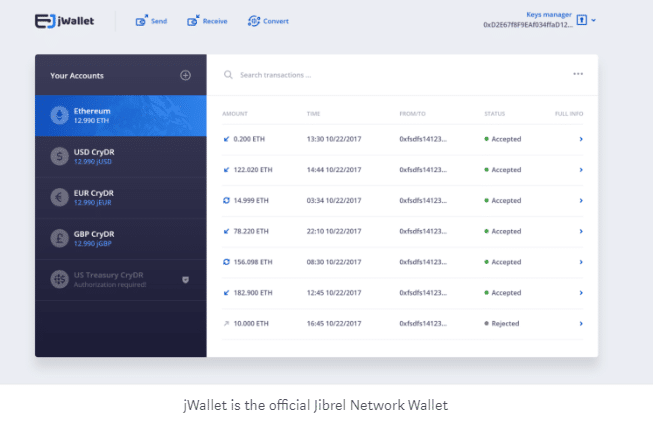

The Jibrel network aims to facilitate the digitization, listing and trading of traditional assets such as fiduciary currencies, bonds and other financial instruments, in the blockchain. The Jibrel decentralized bank will allow users of the platform to deposit cash, money market instruments or create their own cryptographic deposit receipts (CryDR) and benefit from arbitration.

Decentralized organizations and funds that are overexposed in digital currencies can cover their positions and protect their funds with stable assets. In addition, Jibrel will provide developers with a complete platform to develop tools and applications for transactions, investments and hedges, by leveraging traditional tokens backed by assets.

The main stakeholders in the Jibrel ecosystem are fundamentally the users who do not invest, who seek to benefit from the value unlocked by cryptocurrencies and blockchain technology, such as low remittance rates and instant transfers; also traditional investors seeking to benefit from the high returns of emerging cryptoeconomics; and decentralized organizations, funds and crypto-investors, which seek to diversify their cryptocurrencies with stable, low-yield assets. The needs of all stakeholders could be met successfully by bringing the stability of traditional financial instruments to the block chain.

Only four key smart contracts are required for the network to work effectively:

Smart CryDR contracts: Each registered asset will have a CryDR issued in the form of a smart contract. Smart CryDR contracts will comply with the ERC 20 standard.

Jibrel’s decentralized bank intelligent contract: A dedicated JDB intelligent contract will regulate the work of CryDR’s intelligent contracts.

Smart Board of Directors (BODC) Contract: The intelligent contract of the Board of Directors (BODC) is the only mechanism to interact / influence the Jibrel Bank Contract.

Helpers / Utilities (Intelligent Auxiliary Contracts): They will be intelligent auxiliary contracts to enable functions such as switching between contracts that execute different versions and enabling additional API features.

The CryDRs

The CryptoDepository or CryDR receipts are tokens that represent the value of a traditional financial asset, denominated in Jibrel network token – JNT (for example, a CryDR USD has a JNT value of 1 dollar). It can be used for remittances, global payments, operations and coverage. CryDRs can also be used to create automated and decentralized financial instruments, such as bonds, commodities, debt instruments and securities.

With intelligent regulation, CryDRs have built-in rules, taken from the real world and translated into the code of strength and displayed in the ethereum blockchain. Making sure that, although decentralized, CryDRs always follow the rules and regulations of the real world.

The public sale of tokens is taking place from November 27, 2017 to January 26, 2018.

The Jibrel Network Token (JNT) is offered at a price of US $ 0.25.

Due to legal restrictions, citizens and residents of the territories governed by the US. UU And the USA UU They have restrictions to participate in the sale of Token of Red Jibrel.

To know more about details of the network, you can review its White paper.